Looking to maximize your crypto holdings? Explore the exciting world of DeFi (Decentralized Finance) with our curated list of the 5 Best DeFi Apps for Crypto Lending and Borrowing. Unlock the power of crypto lending and crypto borrowing to earn passive income or access instant liquidity without traditional financial intermediaries. We’ll delve into the top platforms offering competitive interest rates, robust security, and user-friendly interfaces, empowering you to make informed decisions in the dynamic landscape of decentralized finance.

Aave: Decentralized Lending at Its Best

Aave is a leading decentralized finance (DeFi) platform offering a robust and user-friendly interface for crypto lending and borrowing. Its strength lies in its non-custodial nature, meaning users retain complete control over their assets.

Aave distinguishes itself through its diverse range of supported cryptocurrencies and its innovative flash loans feature, enabling users to borrow funds without collateral for extremely short periods. This feature unlocks unique opportunities for sophisticated DeFi strategies.

The platform also provides a competitive interest rate system, allowing users to earn rewards on deposited assets while simultaneously accessing loans at favorable rates. Aave’s sophisticated risk management protocols aim to minimize defaults, ensuring a reliable experience for both lenders and borrowers.

Furthermore, Aave’s transparency and open-source nature foster trust and community involvement. The platform’s active development and frequent updates demonstrate a commitment to continuous improvement and innovation within the DeFi landscape.

In summary, Aave offers a compelling combination of features that make it a top choice for individuals seeking a decentralized, secure, and efficient platform for crypto lending and borrowing activities.

Compound: Earn Interest on Crypto Deposits

Compound is a leading decentralized finance (DeFi) protocol that allows users to earn interest on their cryptocurrency deposits. It operates on a supply-and-demand model, where users who deposit crypto assets (suppliers) receive interest, while those who borrow crypto assets (borrowers) pay interest.

Interest rates on Compound are dynamic and fluctuate based on the supply and demand of each asset. Higher demand for a particular asset will generally result in higher interest rates for suppliers. The platform uses a system of algorithmic interest rate adjustments to ensure market efficiency.

Compound offers a wide range of supported cryptocurrencies, enabling users to earn interest on various assets. However, users should always carefully review the risks associated with lending and borrowing in the DeFi space before using the platform. It’s crucial to understand the risks of smart contract vulnerabilities and market volatility.

Using Compound involves interacting with its smart contracts directly, typically through a compatible crypto wallet. Users need to be comfortable with the technical aspects of decentralized applications before participating.

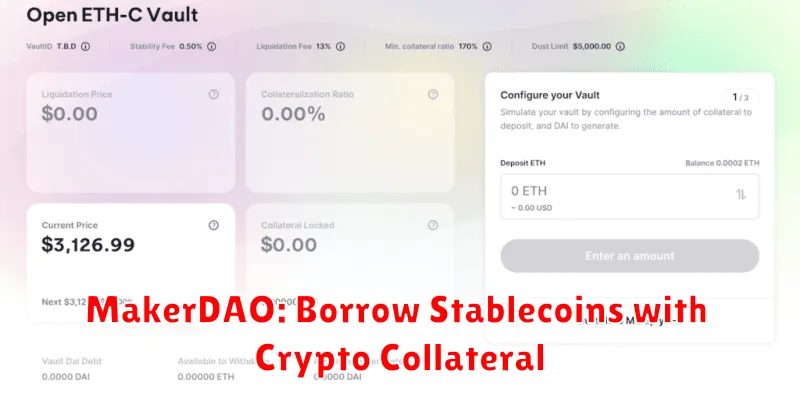

MakerDAO: Borrow Stablecoins with Crypto Collateral

MakerDAO is a decentralized finance (DeFi) platform enabling users to borrow stablecoins, primarily DAI, by locking up various cryptocurrencies as collateral. This process is known as collateralized debt positions (CDPs).

The stability of DAI is maintained through an over-collateralization mechanism. Users must deposit more cryptocurrency than the value of the DAI they wish to borrow. This ensures that even if the value of the collateral drops, there are sufficient funds to cover the loan.

MakerDAO offers a relatively low-risk borrowing option compared to some other DeFi lending platforms, due to the robust collateralization requirements. However, liquidation can occur if the collateral value falls below a certain threshold, resulting in the seizure of the collateral to repay the loan.

Key advantages include the access to decentralized, permissionless borrowing and the relatively low interest rates compared to traditional financial institutions. However, users should be aware of the risks involved in smart contract vulnerabilities and market volatility impacting their collateral value.

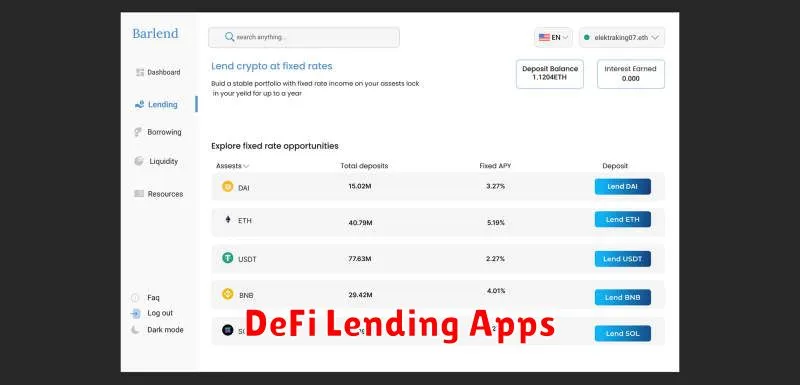

Venus: DeFi Lending on Binance Smart Chain

Venus is a decentralized finance (DeFi) lending and borrowing platform built on the Binance Smart Chain (BSC). It offers users the ability to lend and borrow a variety of cryptocurrencies, earning interest on deposits or accessing leveraged positions.

A key feature of Venus is its use of the XVS token, which provides governance rights to holders and is used to secure loans. The platform aims for high capital efficiency and low transaction fees, leveraging the speed and lower costs of the BSC network.

Benefits of using Venus often include competitive interest rates for both lenders and borrowers, as well as access to a wide range of supported assets. However, users should always be aware of the inherent risks associated with DeFi platforms, including smart contract vulnerabilities and market volatility.

Venus provides a relatively accessible entry point for users interested in DeFi lending, particularly those already familiar with the Binance ecosystem. However, thorough research and understanding of the risks are crucial before participation.

Curve Finance: Optimized for Stablecoin Loans

Curve Finance is a decentralized exchange (DEX) specifically designed for trading stablecoins and other similar assets with minimal slippage. This makes it an excellent platform for obtaining loans, particularly those involving stablecoins. Its low-slippage characteristic ensures borrowers receive favorable exchange rates when borrowing against their collateral.

Key advantages of using Curve Finance for stablecoin loans include its deep liquidity in stablecoin pools, resulting in competitive borrowing rates and efficient transactions. The platform’s focus on minimal slippage significantly reduces the cost of borrowing and repaying loans compared to other DeFi lending platforms. Curve’s efficient mechanism makes it a compelling option for users who prioritize cost optimization in their stablecoin lending strategies.

While Curve Finance doesn’t directly offer loans like Aave or Compound, its integration with other DeFi protocols enables users to leverage its stablecoin pools for collateralized lending. This often results in lower borrowing costs and greater capital efficiency. Understanding how to utilize Curve’s liquidity within a broader DeFi strategy is key to unlocking its benefits for stablecoin lending.