Are you interested in cryptocurrency mining but wary of potential scams? This comprehensive guide, “How to Avoid Common Crypto Mining Scams,” will equip you with the knowledge to navigate the risks and protect yourself from fraudulent schemes. Learn how to identify fake mining software, avoid ponzi schemes disguised as mining operations, and understand the red flags of cryptocurrency mining scams to safeguard your investment and personal information. We’ll cover everything from verifying legitimacy to understanding realistic return expectations, empowering you to mine cryptocurrencies safely and securely.

Recognizing Fake Cloud Mining Services

The cryptocurrency mining landscape is rife with scams, and fake cloud mining services are a common tactic used to defraud investors. These services promise high returns with minimal effort, often leveraging sophisticated websites and marketing materials to appear legitimate.

Unrealistic return promises are a major red flag. Legitimate cloud mining operations offer returns that reflect the actual difficulty and energy consumption of mining. Extremely high or guaranteed returns are almost always a sign of a scam.

Lack of transparency is another key indicator. Reputable cloud mining services provide detailed information about their infrastructure, mining operations, and financial records. If a service is secretive or unwilling to provide such details, it’s likely fraudulent.

Unverified testimonials and reviews are easily fabricated. Always check multiple independent sources before investing. Look for reviews from credible sources, not just those displayed on the company’s website.

High upfront costs or hidden fees should raise suspicion. While some legitimate services may require an initial investment, excessive or unexpected fees are a common tactic used by scammers.

Difficulty in withdrawing funds is a hallmark of fraudulent cloud mining operations. Legitimate services will have a clear and transparent withdrawal process. If you encounter significant obstacles in withdrawing your earnings, this is a strong indication of a scam.

In summary, due diligence is crucial. Thoroughly research any cloud mining service before investing, focusing on transparency, realistic returns, and verifiable reviews. If something seems too good to be true, it probably is.

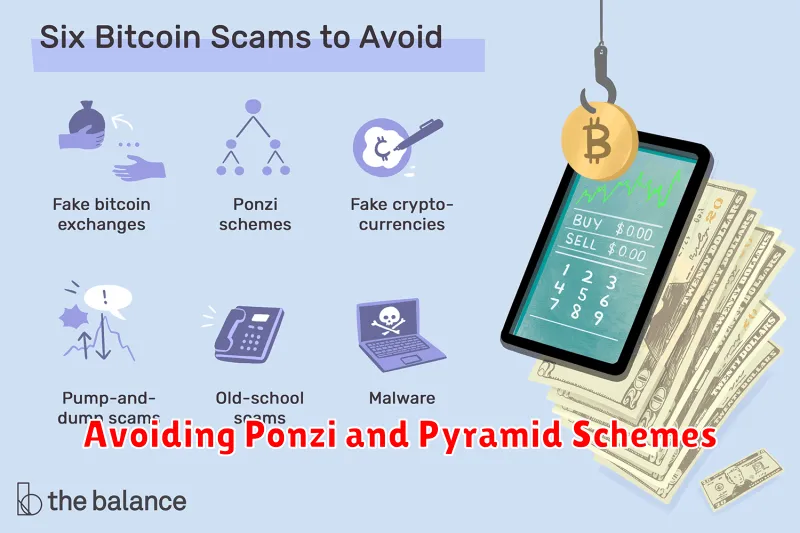

Avoiding Ponzi and Pyramid Schemes

Cryptocurrency mining scams often disguise themselves as Ponzi or pyramid schemes. These fraudulent operations promise high returns with minimal effort, relying on recruiting new investors rather than legitimate business activities.

Ponzi schemes pay early investors with funds from later investors. When new investments dry up, the scheme collapses. Pyramid schemes focus on recruiting new members, promising commissions based on their recruitment efforts, rather than on any actual product or service.

Key warning signs to watch out for include unusually high returns, pressure to invest quickly, promises of guaranteed profits, and a lack of transparency regarding the investment’s underlying operations. Be wary of schemes that emphasize recruitment over the underlying business or product.

To avoid these scams, conduct thorough due diligence. Research the company, its leadership, and its business model. Consult with a financial advisor and only invest what you can afford to lose.

Remember, if an investment opportunity seems too good to be true, it probably is. Legitimate cryptocurrency mining operations require significant investment in equipment and expertise and do not promise unrealistic returns.

Checking Website and App Legitimacy

Before engaging with any cryptocurrency mining website or application, meticulously examine its legitimacy. Verify the website’s security by checking for a secure HTTPS connection (indicated by a padlock icon in your browser’s address bar). A lack of HTTPS suggests a potentially insecure site.

Investigate the website’s “About Us” section for details on the company, its team, and its contact information. Legitimate operations usually provide transparent information. Look for inconsistencies or a lack of readily available contact details, as these can be red flags.

Research the app’s developer. Check app stores (Google Play, Apple App Store) for reviews and ratings. Pay close attention to negative reviews highlighting suspicious activity or lack of developer response. A poorly rated or reviewed app with limited developer information should raise concerns.

Cross-reference information provided on the website or in the app description with independent sources. Search for the company name and related keywords online to see if any reputable news articles, forums, or reviews mention them. Be wary of sites that lack independent verification.

Finally, exercise caution. If something seems too good to be true, it likely is. High returns with minimal effort are rarely legitimate in the cryptocurrency world. Avoid engaging with platforms exhibiting suspicious characteristics or promising unrealistic profits.

Researching Mining Pool Reputation

Choosing a reputable mining pool is crucial to avoid scams. Thorough research is essential before committing your hashing power. Look for pools with a long operational history, a strong online presence, and positive user reviews.

Check independent review sites and forums for feedback on the pool’s payout system, fees, and overall reliability. Be wary of pools promising unrealistically high returns or those with opaque fee structures.

Examine the pool’s transparency. A reputable pool will openly share its hashrate statistics and payment history. Lack of transparency should raise red flags.

Consider the pool’s size and distribution. Larger pools generally offer greater stability and are less susceptible to manipulation, however, extremely large pools can raise concerns about centralization.

Finally, always verify the pool’s website security, ensuring it uses HTTPS and has a valid SSL certificate to protect your data.

Never Paying Upfront for Guaranteed Returns

One of the most prevalent red flags in cryptocurrency mining scams is the promise of guaranteed returns in exchange for an upfront investment. Legitimate mining operations rarely, if ever, offer such guarantees. The inherent volatility of cryptocurrency markets makes any prediction of profit highly speculative.

No legitimate business can guarantee a specific return on investment, particularly in the volatile crypto market. Promises of fixed profits should immediately raise suspicion. These schemes often utilize sophisticated marketing tactics to lure victims into paying exorbitant fees with the false promise of substantial and guaranteed returns.

Instead of focusing on guaranteed profits, reputable mining operations emphasize transparency and realistic expectations. They may disclose potential profitability based on market conditions and operational costs, but they will not guarantee specific financial gains. Remember, high returns often come with high risk; guaranteed returns are almost always a scam.

Due diligence is crucial. Research the company thoroughly. Check for reviews and testimonials from independent sources. Verify their registration and licensing information. If something sounds too good to be true, it likely is.